I Ask AI to Plan My Personal Finances | EASY COMPLETE Beginner Guide

Have you ever found yourself thinking, “Where did all my money go?” 💸 Managing personal finances can be overwhelming with bills, savings goals, and debt.

But what if you could utilize AI to help plan your finances in a matter of minutes? Today's post will give a step-by-step guide on how to use AI to make your financial planning easier by using tools such as ChatGPT.

Why Use AI for Personal Finance? 🧠

Personal finance involves budgeting, tracking spending, paying off debt, and saving for future goals—it can get overwhelming. AI simplifies this by organizing everything in one place.

AI tools like ChatGPT can create a budget based on your income, suggest ways to cut unnecessary spending, and help you stay on track with your saving goals. It's like having a financial advisor on hand—without the fees! 💰

Think about it: no more manual tracking or confusing spreadsheets. Just tell AI what you need, and it helps you plan and manage your money in minutes!

Crafting the Right AI Prompts: Ask Before Answer Prompting 📝

One challenge with AI chatbots is getting accurate responses. Sometimes, the AI may give an answer based on limited information. That's where the Ask Before Answer Prompting technique comes in.

With this framework, you guide ChatGPT to seek clarification before attempting an answer, ensuring it has all necessary information.

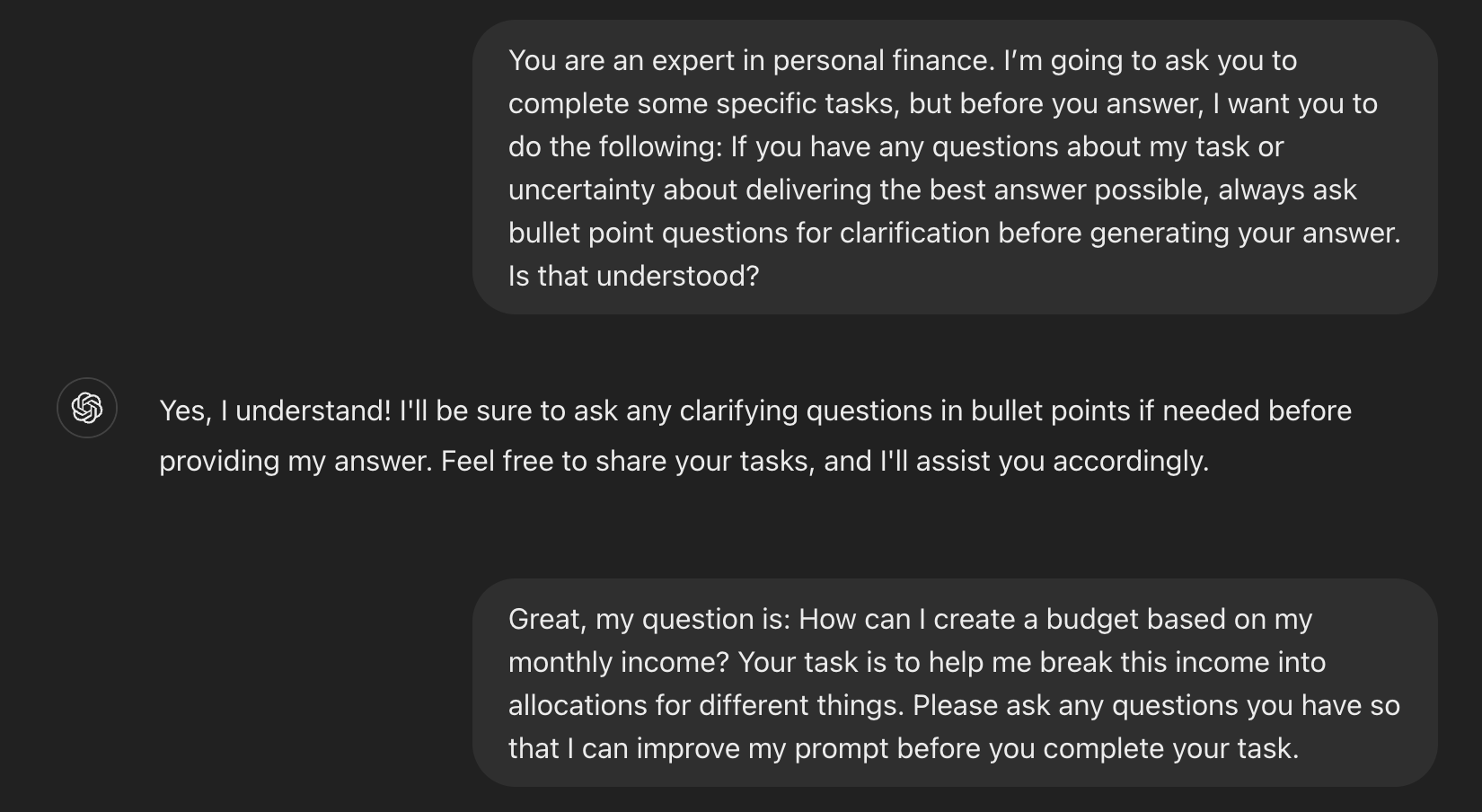

Step 1: Establish ChatGPT as an Expert

Start with a prompt like:

You are an expert in personal finance. I'm going to ask you to complete some specific tasks, but before you answer, I want you to do the following: If you have any questions about my task or uncertainty about delivering the best answer possible, always ask bullet point questions for clarification before generating your answer. Is that understood?

This tells ChatGPT to ask for clarification when unsure.

Step 2: Present Your Request

Then, present your request:

Great, my question is: How can I create a budget based on my monthly income? Your task is to help me break this income into allocations for different things. Please ask any questions you have so that I can improve my prompt before you complete your task.

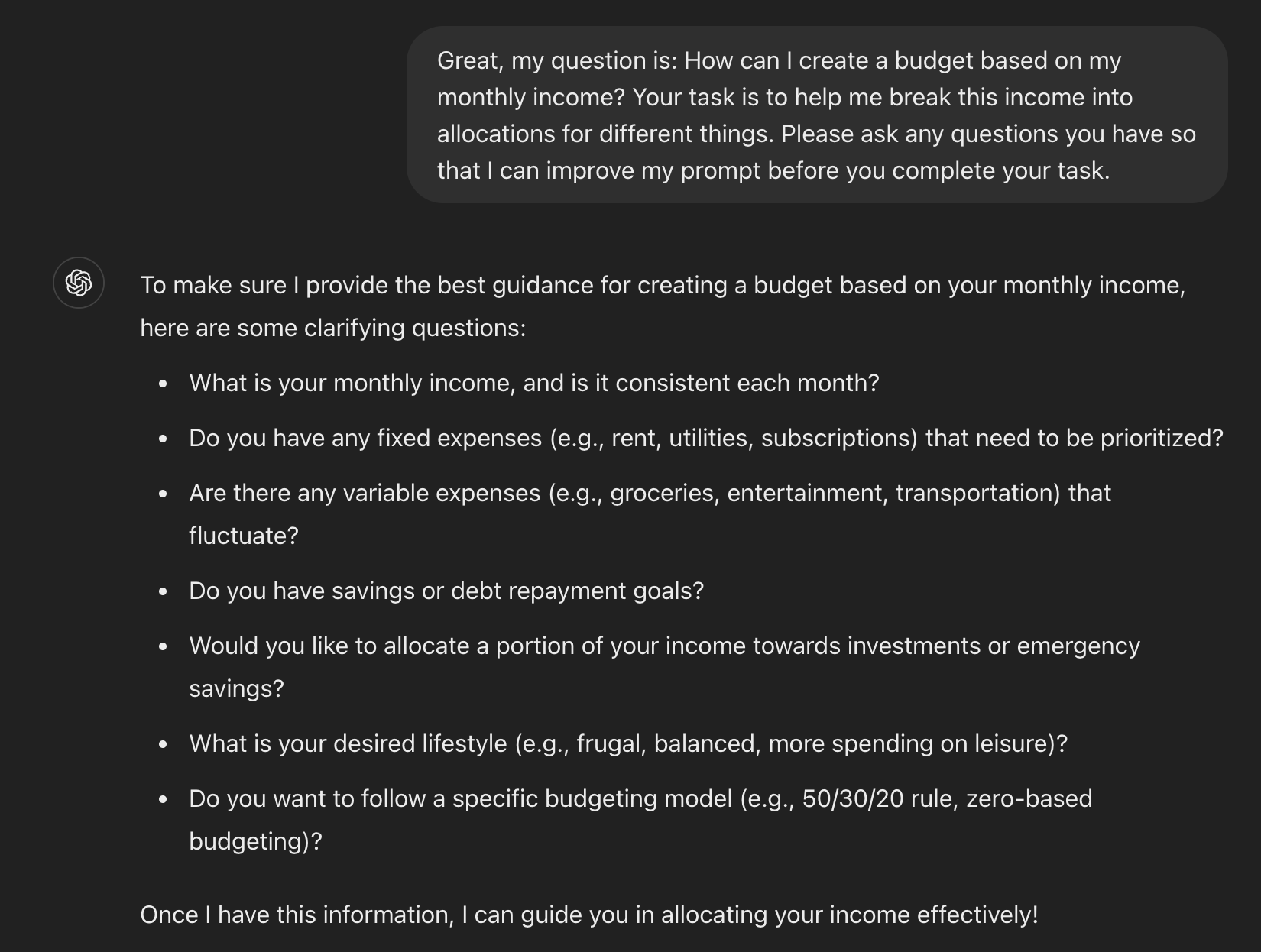

ChatGPT will ask for details, such as your expenses and savings goals.

This helps refine your prompt so ChatGPT can provide precise and helpful answers. It's especially useful for tasks requiring detailed answers, like financial planning.

Remember, try Ask Before Answer Prompting to guide ChatGPT in asking the right questions, making your financial planning more tailored to your needs. This simple trick will get you better results! 🎯

Using ChatGPT to Build Your Budget 💡

Let's walk through how to use ChatGPT to create a budget based on your monthly income.

Step 1: Start with the Initial Prompt

Use the prompt from the previous section.

Step 2: Provide Details

ChatGPT will ask for details about your fixed and variable expenses, savings goals, and investment preferences.

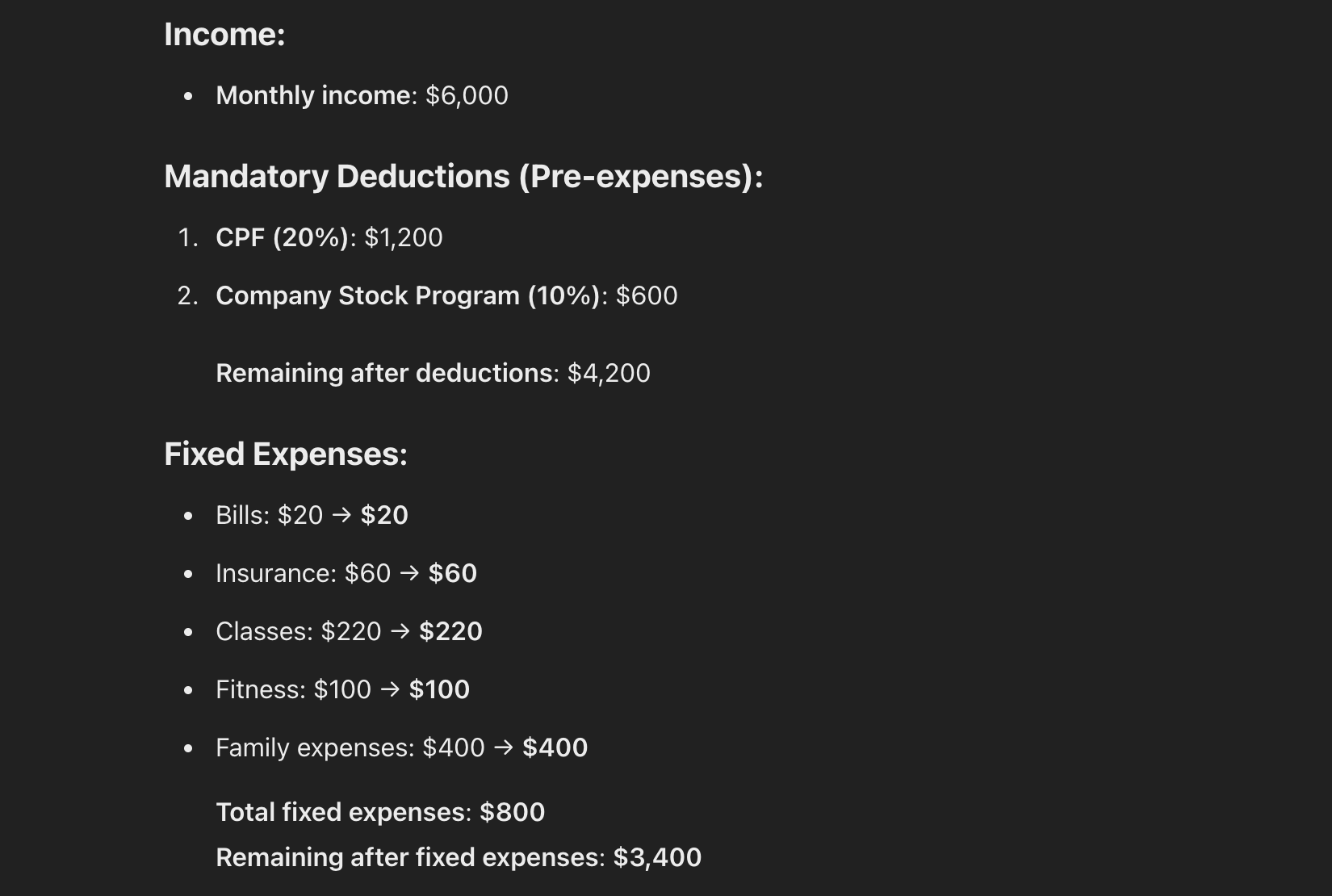

For example, let's say you have a $6,000 monthly income, allocate 20% to CPF (Central Provident Fund), 10% to a company stock program, and have fixed and variable expenses to cover.

Provide your actual expenses, such as:

- Fixed Expenses:

- Rent/Mortgage: $800

- Variable Expenses:

- Food: $300

- Transport: $100

- Utilities: $100

- Gym Membership: $200

- Entertainment: $100

- Savings Goals:

- Emergency Fund

- Investing in Stocks

Step 3: Review the Budget Breakdown

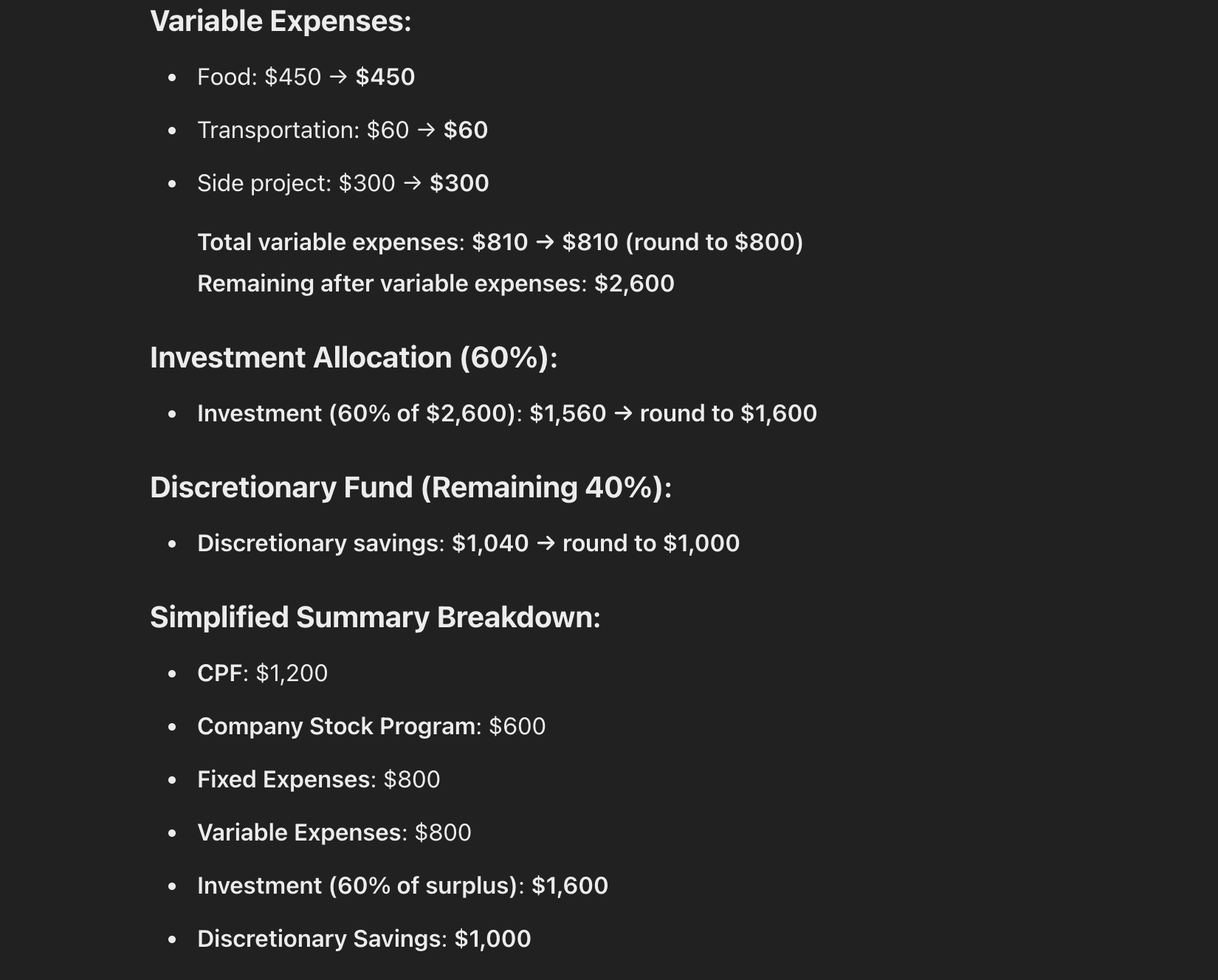

Here's how ChatGPT divided the income:

- Fixed expenses: $800

- Variable expenses: $800

- Investments: $1,600

- Discretionary savings: $1,000

ChatGPT summarized your expenses in seconds, helping you understand allocations.

Step 4: Refine Your Budget

You can continue to prompt ChatGPT by asking it to round the expenses, investments, and savings so it is easier to allocate the budget.

Now, this is much more understandable. Note down this summary breakdown, and you can already start following this plan right away!

Step 5: Ask for Budgeting Model Suggestions

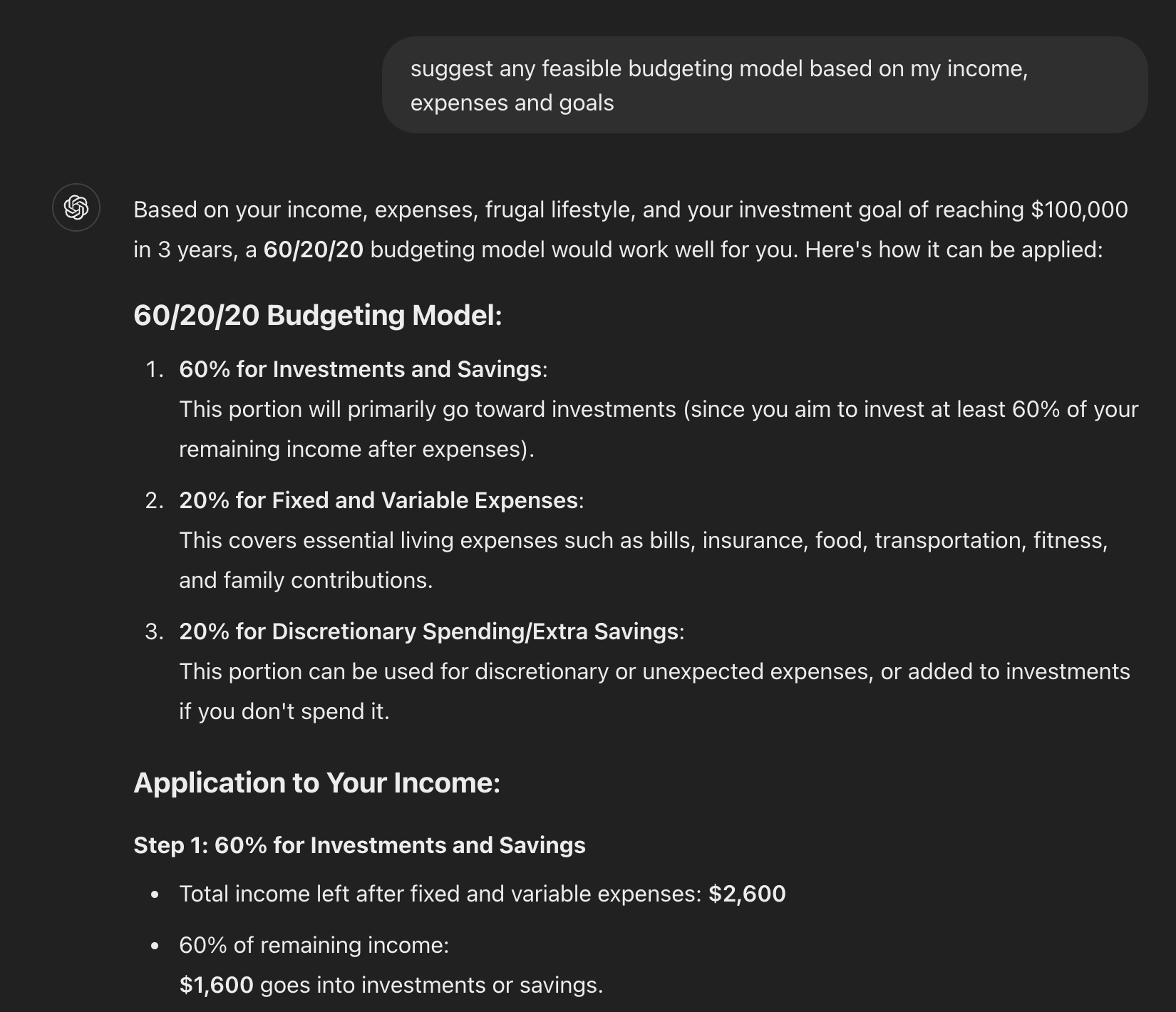

Now that we have a basic breakdown, let's take it a step further! 🚀 I asked ChatGPT to suggest a budgeting model that fits our income, expenses, and goals.

Guess what? ChatGPT came through with the 60/20/20 budgeting model. But here's the cool part: depending on what you tell ChatGPT about your situation, you might get a totally different suggestion! 😮

So go ahead, give it a try! Ask ChatGPT for a budgeting model that suits your unique financial picture. You might be surprised at what it comes up with! 💡💰

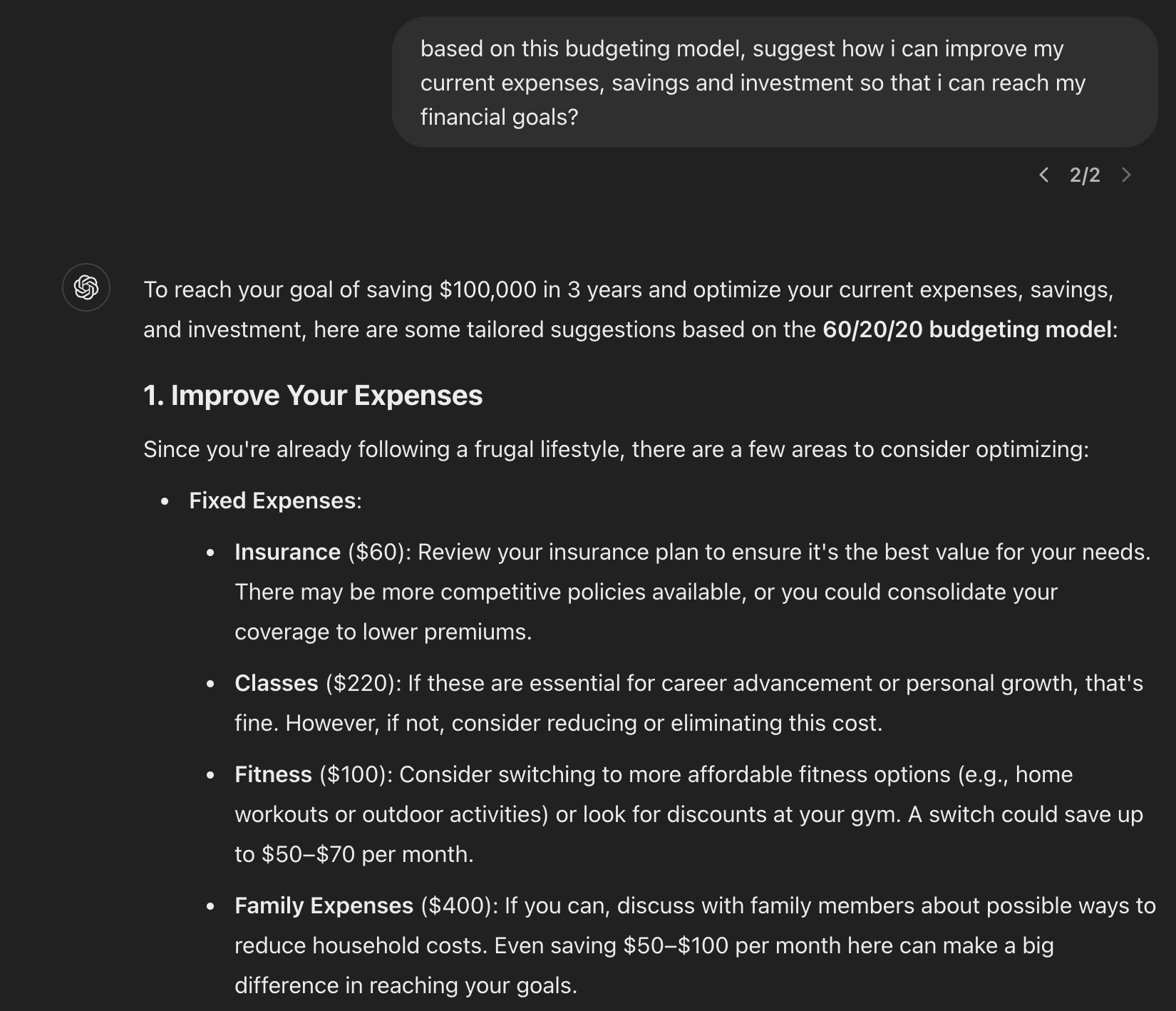

Optimizing Your Expenses with ChatGPT 🧐

With your budget, ask ChatGPT for advice on improving expenses, savings, and investments to reach your financial goals.

ChatGPT may suggest:

- Reviewing insurance plans for better rates.

- Switching to a cheaper fitness plan.

- Cutting food costs by meal prepping.

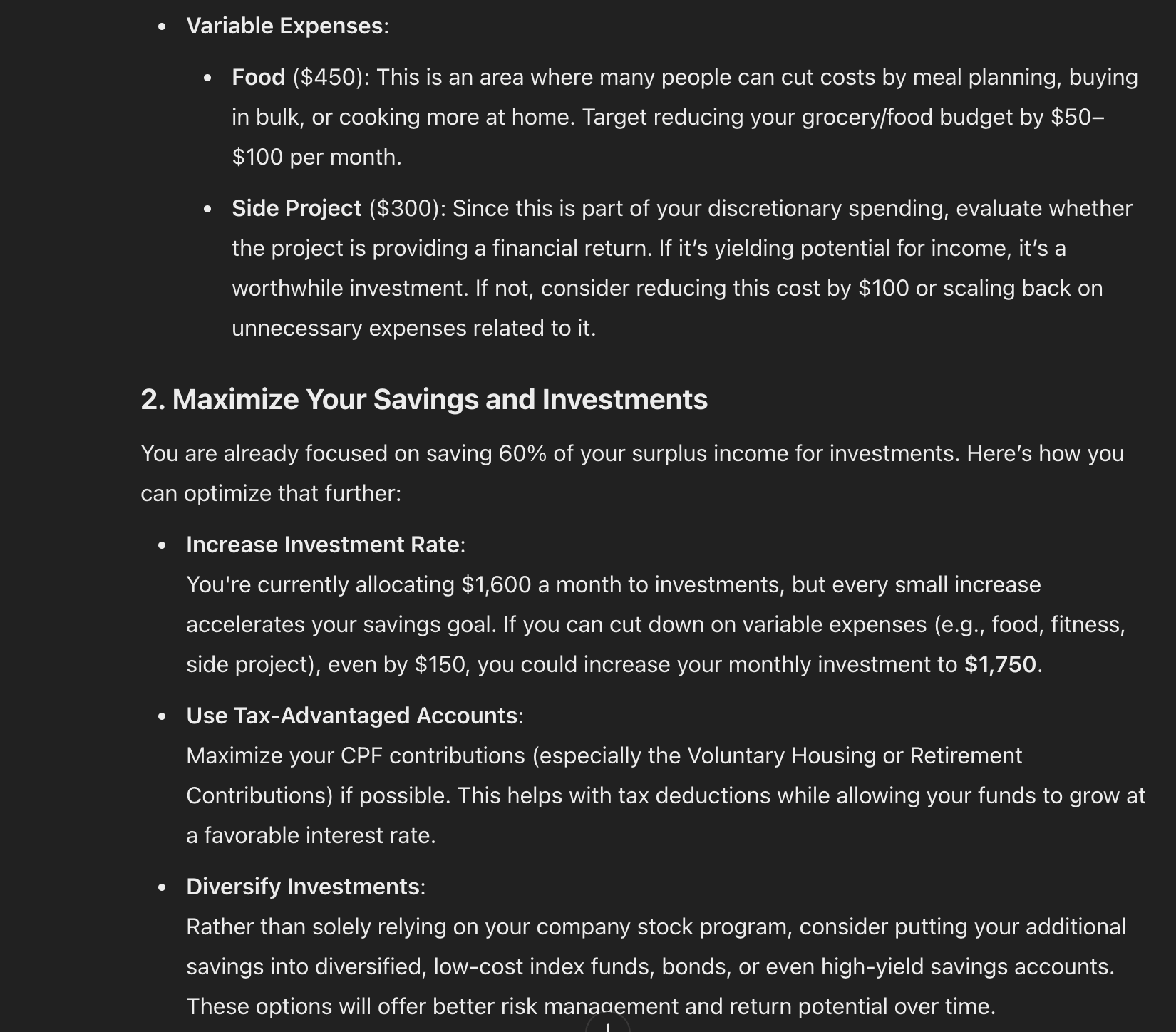

To maximize savings and investments:

- Utilize tax-advantaged accounts like CPF contributions.

These small changes can free up more money for investments, bringing you closer to your $100,000 goal faster! 🚀

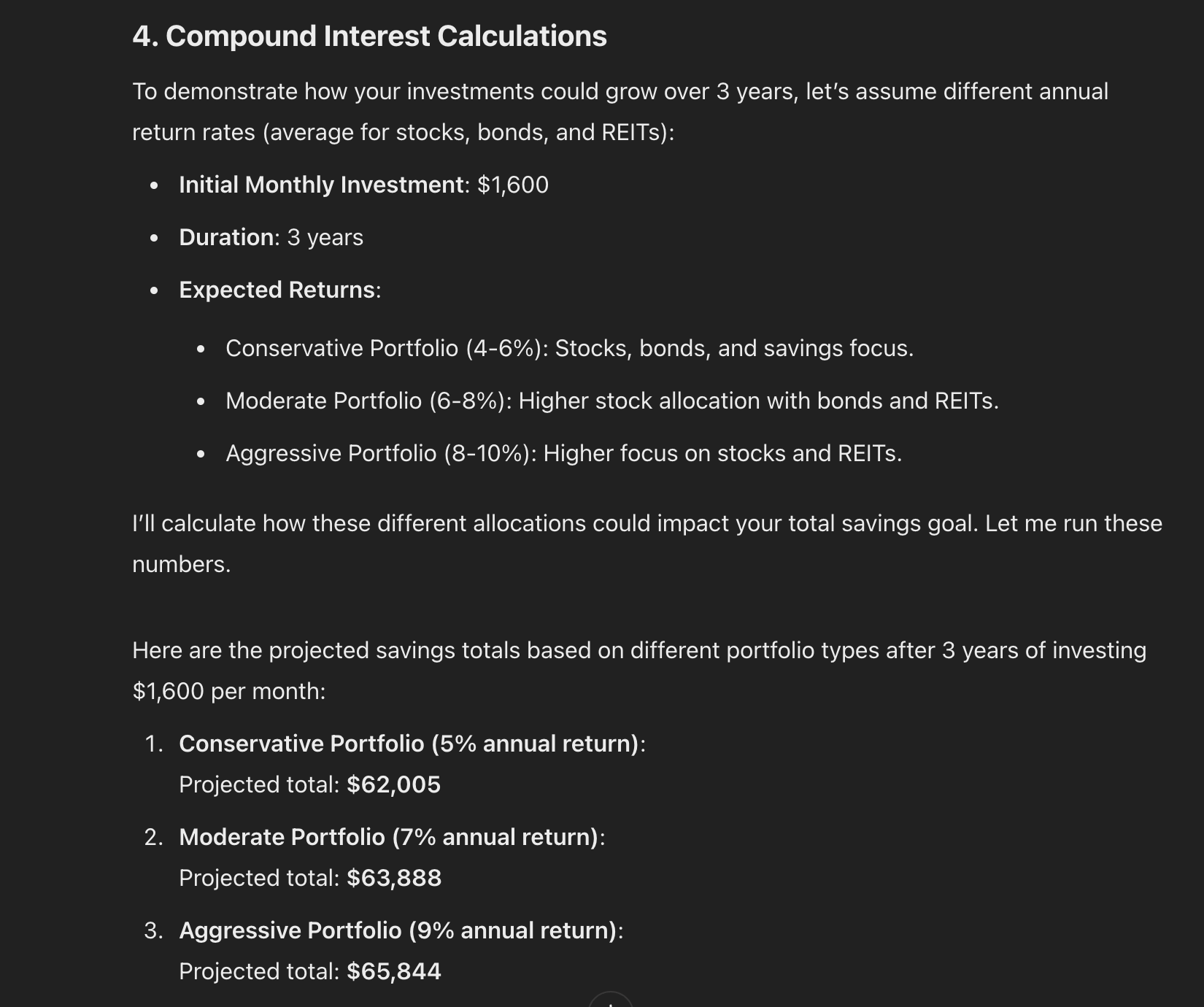

Maximizing Investments with ChatGPT 📈

ChatGPT can suggest ways to diversify investments, like stocks, bonds, and REITs. However, I'm not a financial advisor, and you shouldn't rely solely on AI for financial advice.

For custom-tailored plans, seek out a professional financial advisor.

With ChatGPT, you'll have an idea of how to distribute the remaining income into investments through dollar-cost averaging and reinvestment of dividends.

By following this strategy, you could grow investments significantly over time.

AI Tools for Financial Planning 🛠️

There are AI-powered tools for financial planning.

Copilot Money

Copilot Money connects to your bank accounts, credit cards, and investments, giving you an overview of your finances in real-time.

It automatically categorizes transactions, helping you see where your money goes.

This app helps manage your finances with a clear, user-friendly interface.

Summary of Actionable Steps ✅

Here's a quick recap:

- Use the 'Ask Before Answer' Prompting Technique.

- Create a Personalized Budget using ChatGPT.

- Optimize Your Spending with ChatGPT's suggestions.

- Explore AI-Powered Tools like Copilot Money.

By following these steps, you'll be on your way to managing your finances with AI! 🎉

Final Thoughts 💭

That's it! A guide to using AI to manage your personal finances. If you found this post helpful, share it with your friends.

Let me know how AI has helped you with your finances—I’d love to hear your experiences!

For more tech tips and AI news, subscribe to the DayTech newsletter.

Thanks for reading, and I'll see you in the next one. Bye! 👋